Booking Holdings (BKNG) and Sabre (SABR) are two leading companies in the travel reservation industry. Booking focuses more on consumer buying as the top third-party vacation/destination/hotel/airline/cruise/car rental marketer and online technology reservation company through its Booking.com and priceline.com websites. Sabre, a spin-off of American Airlines (AAL) in 1999, mainly works with businesses on ticketing/reservations to match air travel, local transportation and hotel needs. They both have suffered during the travel recession this year. Sabre revenues are expected to slide -60% in 2020 due to the pandemic economic shutdown, with Booking sales backpedaling -50%. However, the similarities end there.

Booking’s super-high profit margins and cash position are projected to keep the company profitable during the year, while Sabre’s excessive leverage and low margins are producing huge operating losses. I wrote a bullish article on Booking in July explaining the company as the smartest, low-risk way to play a slow rebound in travel, after coronavirus issues subside.

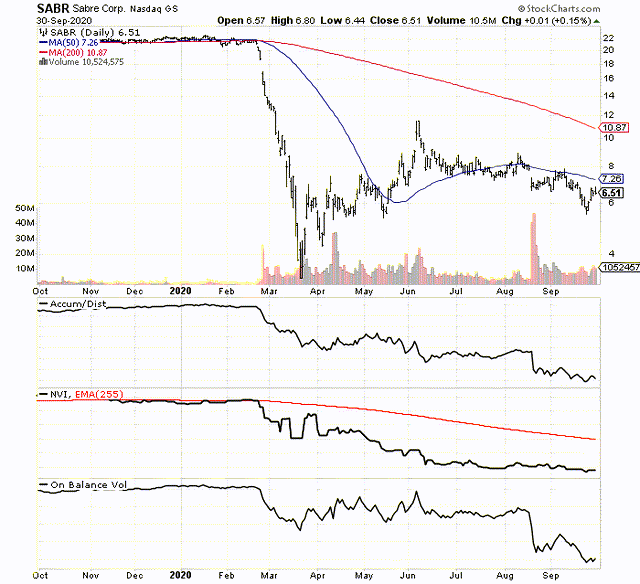

I mentioned Sabre a few weeks ago in a computer sort article. The stock is in a very weak technical position, and could witness exaggerated selling volumes, alongside a deeper price decline on any bad news into 2021.

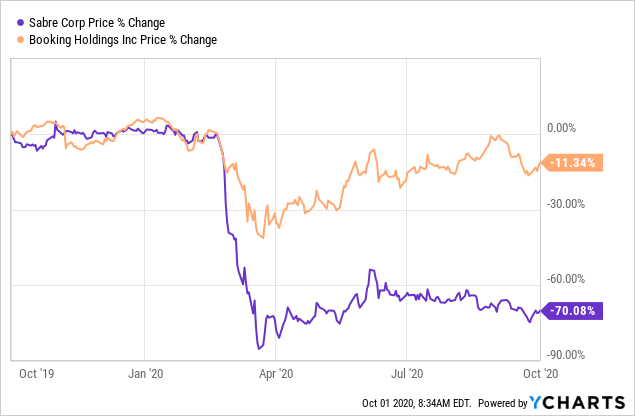

The purpose behind a pair trade long in Booking against a short in Sabre is an investor can earn substantial profits given a gradual resumption in travel activity from September’s still low level. In addition, if we get a large second wave of virus spread this winter, derailing the travel comeback, investors may still be able to earn sizable profits in the spread positioning. How can that be? Well, Sabre’s shares are down -70% over the past 12 months, while Booking’s quote has declined only -11%. An equally-weighted dollar long/short setup would have earned about +59% (before trading and margin expenses) from owning the low-risk long, and selling the high-risk short picks in the travel reservation sector.

How many other trade designs can earn you a profit no matter which direction the economy or Wall Street pricing move the rest of 2020 into 2021? If your goal is to reduce market volatility and generate positive returns in either an up or down Wall Street macroeconomic scenario, this trade has the potential to help your portfolio’s value and personal wealth future.

Law of the Jungle: The Strong Survive

In terms of balance sheet safety, Booking held $7 billion in net liabilities after subtracting cash holdings during the latest quarterly reporting period. This debt and IOU sum compares quite strongly with $11 billion in trailing 12-month revenues, and $3 billion in operating profit. Conversely, Sabre held $4.5 billion in net liabilities vs. $2.7 billion in trailing annual revenues and a -$300 million operating loss into June. If we were to assume travel trends do not improve in 2021-22, the conclusion is Booking will thrive, while Sabre could be forced out of business (or to restructure debts and equity in a negative fashion for current stakeholders) in coming years. Image Source: Booking Website

Image Source: Booking Website

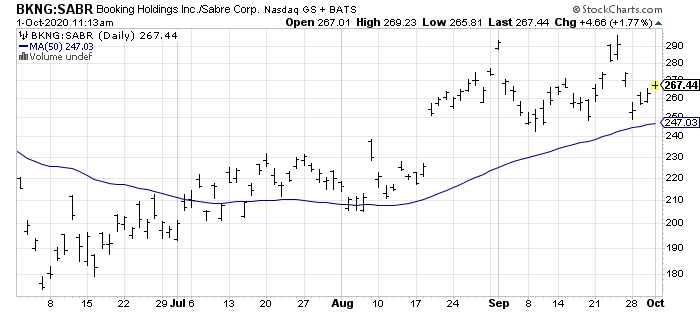

Sabre’s leverage position is definitely putting shareholder worth at risk, as its underlying business trends go bust in 2020. With business travel reservations (especially airline related) the primary focus of operations, Sabre is ground zero for a Wall Street sell-off in value. The stock quote has continued to significantly underperform both the U.S. market indexes and Booking in particular during late summer. Over the last four months, Booking has handily bested Sabre’s price change performance, pictured below.

Plus, I can argue overall travel demographics could be moving into reverse for the industry long term. The biggest traveling age group in the U.S., baby-boomers, are entering the twilight of their lives. With many above age 70, and the economy in recession, health and money reasons will encourage growing numbers to stay close to home. Incomes for other Americans as a whole are either falling or consumers with spending dollars are worried about discretionary purchases on things like leisure and holiday travel. Lingering fears of catching COVID-19 could last for years. Businesses that have cut travel expenses in 2020 may restrain employees from meeting customers and clients across the country at the same rate as 2019, possibly forever. What if 2019’s travel rate is not surpassed again for a decade? Don’t say such is impossible. The math, and some common-sense logic, says it’s entirely possible, if not probable travel trends will not recover quickly.

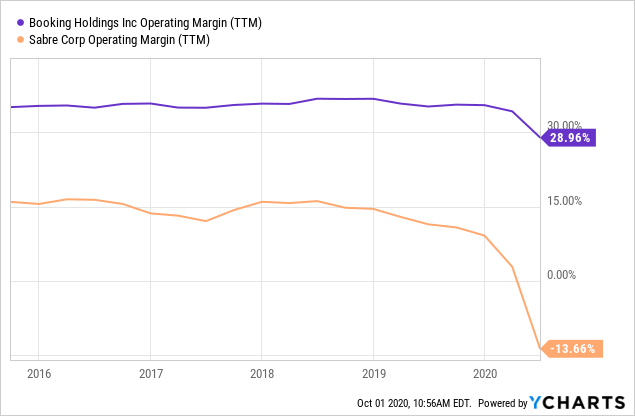

Profit Margin & Leverage Comparison

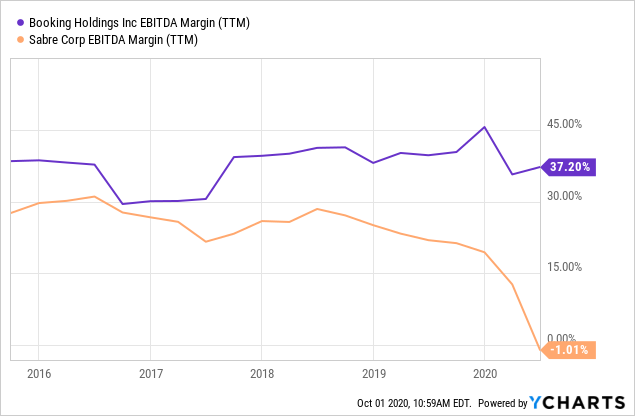

To highlight the night and day setup for investments in each, I have selected some data points to review and contemplate on 5-year charts. Operating margin is the quickest and easiest calculation to determine a company’s real world success, especially comparing two companies in the same field. As an owner, you want to find a high margin, safe revenue stream business to invest your hard-earned capital. Booking looks good on the profitability front, while Sabre is now generating steep operating losses.

EBITDA margins also highlight the cash flow and earnings crunch hitting Sabre this year. Even before factoring in interest expense on high debt levels, the company is having difficulties meeting its bills from existing revenue and cash flows. [The only bright spot on Sabre’s balance sheet is the company held over $1 billion in cash and working capital at the end of June. This surplus of liquidity should be enough to keep the business alive the next 6-12 months.]

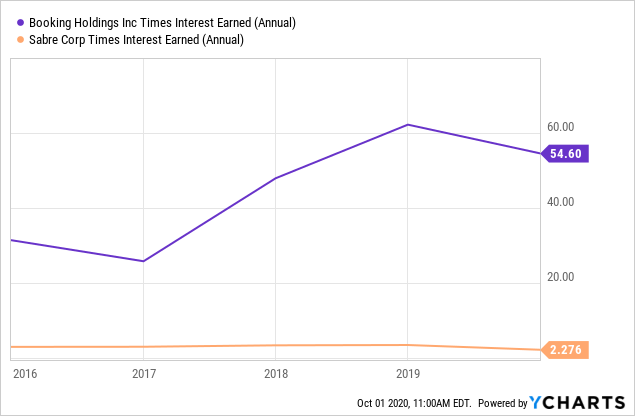

Interest expense then creates a monster loss for Sabre. Below you can see Booking earned 54x the level of interest expense on total debt going into the 2020 travel bust. Sabre’s equivalent was just 2x, and now “earnings” have turned into losses.

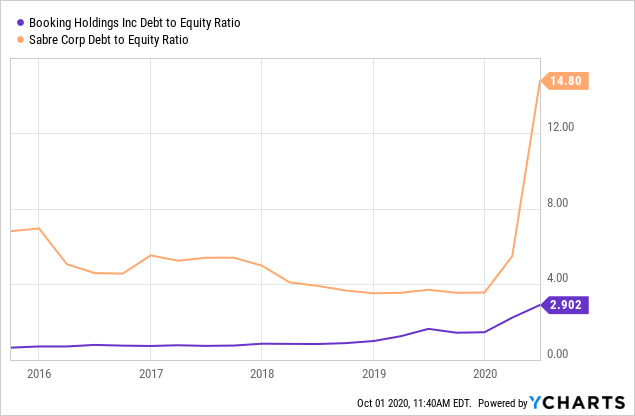

The disastrous first six months of 2020 have wiped out most all of the underlying book value in Sabre, and the travel disruption is far from over. Below is a chart of debt to equity for both enterprises. Sabre’s line is skyrocketing, as underlying shareholder worth is decimated by the operating losses taking place.

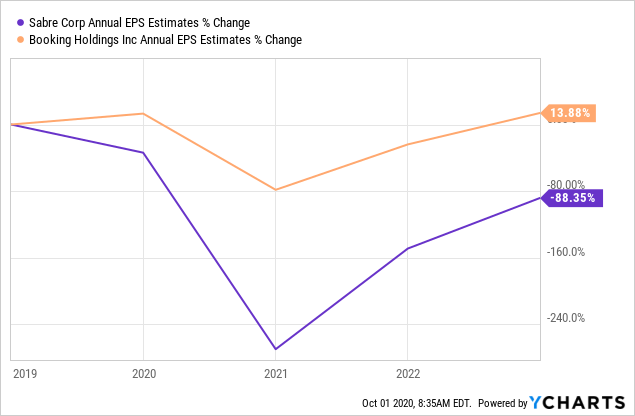

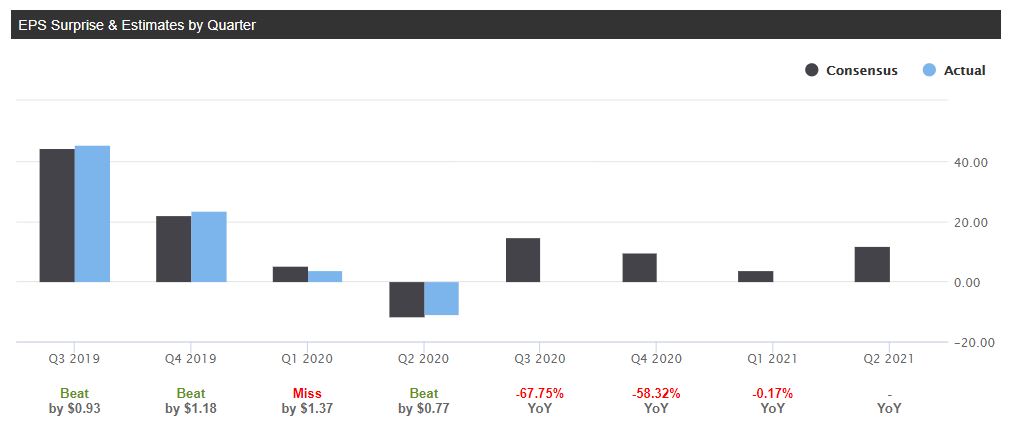

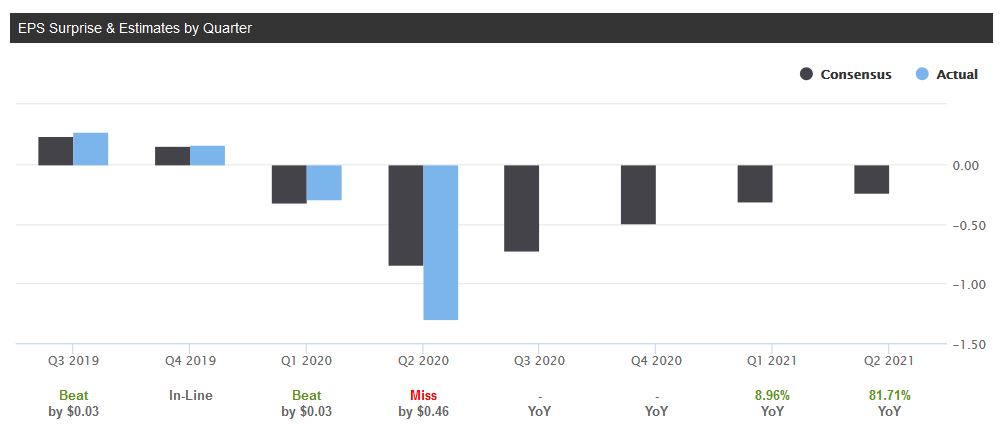

Earnings estimates into 2021-22 also paint a picture of disparate realities. While Booking’s EPS is projected by Wall Street analyst consensus to rapidly return to pre-coronavirus levels, Sabre is expected to bleed considerable sums of capital to stay in business during 2020-22, with breakeven to small profitability estimated by late 2022, into 2023.

Booking Holdings Quarterly Estimates

Booking Holdings Quarterly Estimates

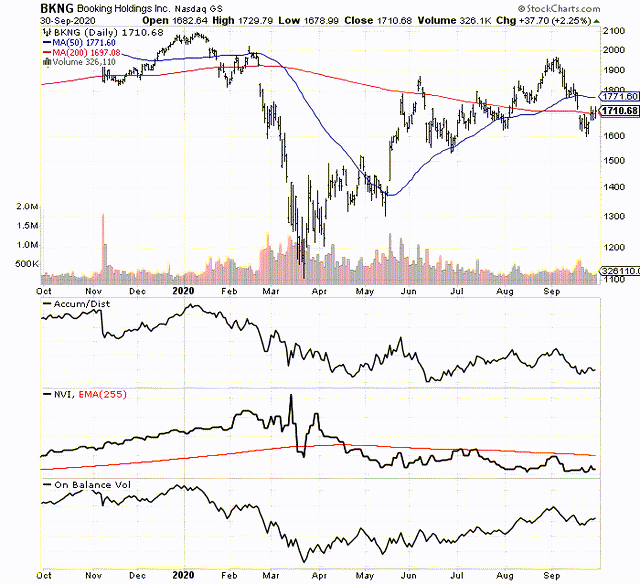

Diverging Chart Patterns

The technical trading trends in both companies also look quite different. For Booking, the stock quote has held up as well as any other travel-related business in 2020. While airlines, cruise lines, hotels and vacation destination companies have crashed or faltered mightily, Booking’s underlying long-term value has not changed substantially. Below is a chart of the situation. The Accumulation/Distribution Line [ADL], Negative Volume Index [NVI] and On Balance Volume [OBV] indicators have been weak in 2020, but not catastrophically so.

Final Thoughts

Final Thoughts

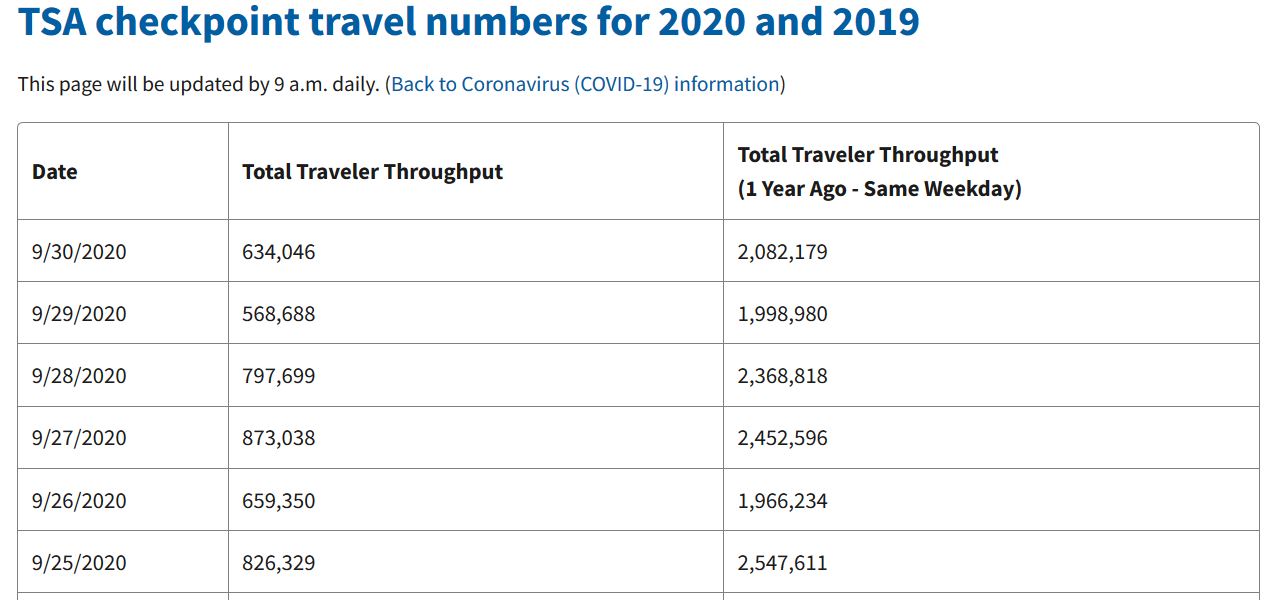

Travel rates may not approach 2019 levels until 2022-24, depending on which Wall Street forecaster you want to follow or believe. TSA checkpoint numbers at the nation’s airports are still quite depressed. In late September, the number of flyers stands near 30% of last year’s level. The good news is the number of air travelers is up from the April low under 5%. However, the increase in traffic has been gradual the last five months, and is not guaranteed to remain in a regular uptrend.

Image Source: TSA Checkpoint Data

Image Source: TSA Checkpoint Data

Investors can still profit from the sector, no matter the length of time needed for vacation and business travel to fully recover. Is a long Booking, short Sabre design guaranteed to earn nice profits going forward, like it has during 2020 to date? Absolutely not. A take private (or merger) offer for Sabre could lead to oversized gains from $6 a share. An actual vaccine fix for the coronavirus problem could save the company from almost certain peril. Booking could simply lag any rebound in Sabre’s fortunes, in percentage terms. Finally, Sabre’s short interest is a material 16% of shares outstanding. Rapid price increases are possible through a short squeeze, given a good excuse to rally. There are definitely some risks to ponder in this long/short pair construct.

Nevertheless, the strongest upside scenario for such a trade (reward outcome) would be slow travel activity in America next year translates into an improving Booking equity quote, while Sabre dips toward insolvency and/or business reorganization later in 2021. From today’s quotes, a minor gain in Booking vs. a serious drop in Sabre would generate dramatic gains for investors.

Believe it or not, Seeking Alpha author sentiment is more bullish on Sabre. Bottom fishers and turnaround ideas abound, especially regarding travel. We all desire a quick “V” shaped recovery in the economy and travel generally. Human nature is still processing the COVID-19 economic mess and its long-term consequences on society. Despite investor hopes for a normalized business rebound, the SA Quant rating for Sabre is incredibly bearish right now. A function of ultra-weak stock price movements and downward earnings/revenue revisions, unemotional computerized research is screaming to stay away from Sabre.

Since the latest financial statement of operations, Sabre has raised $500 million in a dilutive common and preferred equity offering and $850 million in debt for refinancing purposes. Estimates during the summer pegged cash outflows of $50-80 million monthly, if business demand fails to pick up.

Investors should understand you can lose more than you invest initially in a short. A stock can rocket higher unexpectedly in a takeover bid or short squeeze event. Limiting your total short position inside an overall net-neutral to somewhat net-long design should prevent serious portfolio losses during a sharp, unexpected stock market bull run. Another risk-control method is to keep your individual short positions small in size and heavily diversified to smooth portfolio volatility. Consulting with a registered and experienced investment advisor is recommended before making any trade, especially if you are new to short-sale mechanics.

Want to read more? Click the “Follow” button at the top of this article to receive future author posts.

Disclosure: I am/we are short SABR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may initiate a long position in BKNG over the next 72 hours.

This writing is for informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. This article is not an investment research report, but an opinion written at a point in time. The author’s opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. Any and all opinions, estimates, and conclusions are based on the author’s best judgment at the time of publication, and are subject to change without notice. Past performance is no guarantee of future returns.

Image Source:

Image Source: Sabre Quarterly Estimates

Sabre Quarterly Estimates In stark comparison, Sabre’s price performance has been downright rotten. In addition, the straight down direction all year of the ADL, NVI and OBV creations mean the selling has been intense and regular in its shares. Plus, all three indicators reached a 52-week low area last week, when the share price was closer to $5.50. The fact Sabre is still 40% below its 200-day moving average is also noteworthy. While the U.S. stock market recovered back to pre-pandemic levels in late summer, and is again just underneath all-time record highs, Sabre’s technical setup is one of the worst I can find for any S&P 400 midcap or S&P 500 large capitalization equity.

In stark comparison, Sabre’s price performance has been downright rotten. In addition, the straight down direction all year of the ADL, NVI and OBV creations mean the selling has been intense and regular in its shares. Plus, all three indicators reached a 52-week low area last week, when the share price was closer to $5.50. The fact Sabre is still 40% below its 200-day moving average is also noteworthy. While the U.S. stock market recovered back to pre-pandemic levels in late summer, and is again just underneath all-time record highs, Sabre’s technical setup is one of the worst I can find for any S&P 400 midcap or S&P 500 large capitalization equity.